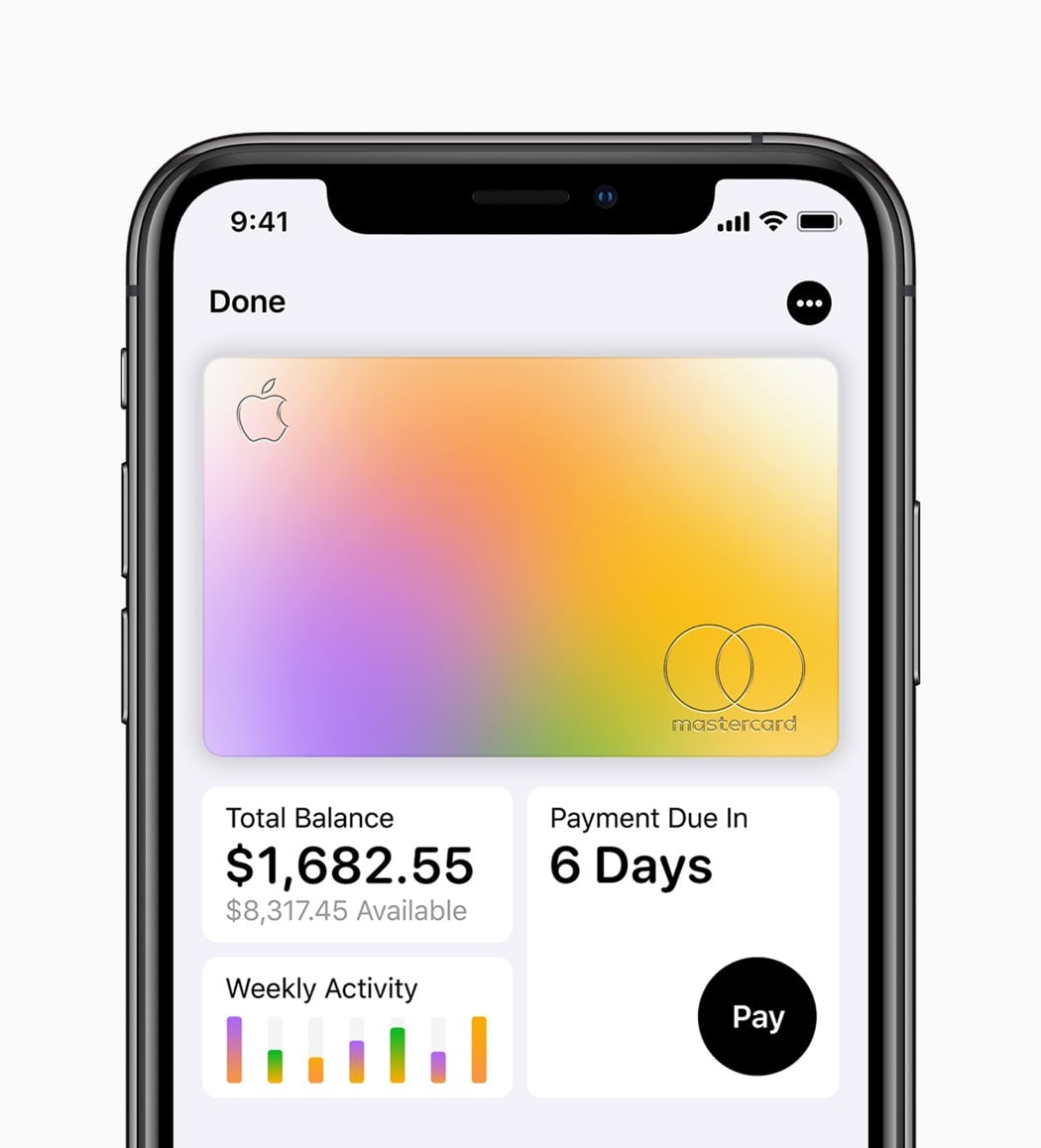

I’ll just list a few features that Jennifer Bailey, the VP of Apple Pay, had to say about Apple’s latest offering… Apple Card. Designed to be the most efficient, useful, transparent, financially beneficial, and well-designed thing to happen to the banking industry, Apple Card is both a physical and digital credit card for Apple users to make payments through. The card works universally, encrypting all your payments and related data, it records all your transactions in a way that’s more easy to understand than looking at your bank statements and trying to figure out where the hell you spent all your money, it breaks down all your payments into easy-to-understand blocks, and even uses map data to remind you where you made what payment. The card works all your life and never expires, it allows you to make credit payments in a way that helps you save on interest, Apple doesn’t charge late fees on your bill payments, ever, and even does you the benefit of giving you a 2-3% cashback on all your transactions… ALL of them. Signing up for the Apple Card takes all of 10 minutes, unlike banks that require days to process your applications, and the card service can be used internationally without incurring any international fees. In every way, this is Apple saying that it cares about its customers and promises to do good by them, and is pretty much a mic-drop moment for Apple as it transitions from products to services. The card resides within your phone, and can be used anywhere Apple Pay would… but in the event that you’re required to make a payment at a place that doesn’t support Apple Pay, Apple even supplies its users with a solid titanium credit card. Designed to be used all your life, the card is simplistic, and has your name etched into it. No card number, no CVV, no expiration date, and no signature. It’s literally the iPod of credit cards…

Apple Card comes as a result of Apple’s collaboration with Goldman Sachs on the banking front, and with MasterCard on the tech-enabled payments front. With how popular Apple Pay has become over the past few years, Apple finally thought it was time to show banks how it should be done. Apple Card as an interface is incredibly intuitive. Rather than listing down various irrelevant details, it organizes all your payments data in a way that’s expected of Apple. The interface is absolutely beautiful, and Apple’s littered it with a whole bunch of incredible features, including payments that are secured using TouchID or FaceID, encrypted payments that don’t even allow Apple to know what you’re buying, where you’re buying it from, and how much you’re buying it for, along with a cashback rewards system that’s instantaneous. With every transaction you make using the digital Apple Card, you get 2% of it as cashback (actual cash that you can use as money, or send to friends as payments), while using the physical Apple Card yields a 1% cashback reward.

With over a billion users across the world, Apple’s card service is an instant feature that helps you make any payment, anywhere, anyhow, just with your smartphone. Designed to provide value to its users, Apple even promises to provide lower-than-usual interest rates. The card service, in return, will never expire, will yield rewards, will be internationally compatible, will never incur late fees… and perhaps the most important part of this entire experience, will remain absolutely secure and private… even from Apple.

Designer: Apple

https://www.youtube.com/watch?v=e7hIThPswuc